The global pandemic has changed many things, from our lifestyle, and where and how we work, to various key industries, such as restaurants, retail, and real estate. As independent landlords, we have seen drastic changes in the real estate industry, and all these changes require us to adapt our processes, operations, and sometimes even business model in order to stay in the game. This article provides some useful tips and suggestions on how we can adapt to the new reality from these four angles: strategy, operation, process, and social.

Stick to a long-term strategy

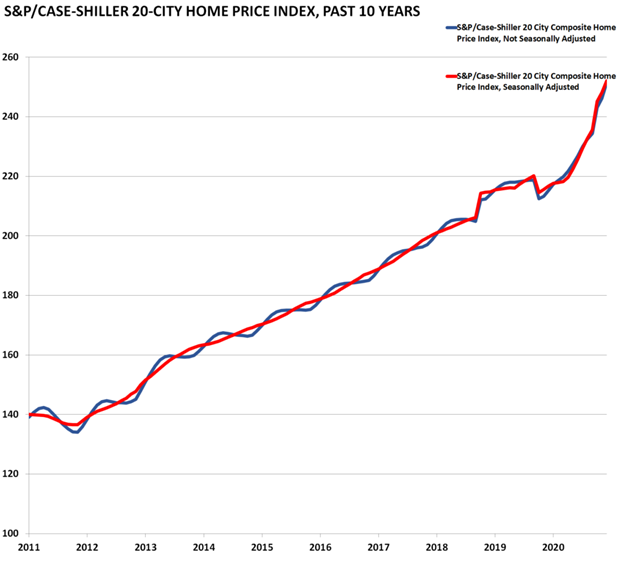

One year into the pandemic, the average property price in the US skyrocketed. When you think about it, it’s truly insane, as, in certain areas, the property price is completely decoupled from the local purchasing power.

But, again, we are talking about a global pandemic, so, perhaps we need to loosen our standard of sanity. Just like for many landlords, the inflated asset price may seem to benefit me at first as I’m about four times leveraged in my real estate portfolio and my debt stayed the same while the valuation increased, increasing my equity significantly. However, I’m still on track to expand my portfolio, and the sudden increase in the price actually hurts my plan to buy more cash-flowing properties.

Then, does it mean I should change my strategy? Instead of buying more properties, I should just refinance the equity and invest in something else? Probably not, and here is my rationale. While real estate price is flying toward the moon, the stock market level is also on a course to Mars. As much as they may appear to be different investment vehicles, in the past year, they were driven by the same force: record low-interest rates. Federal reserve set the baseline interest rate range, and that’s the baseline for ALL investment returns. So, with the record-low interest rate, you can only expect a low cash-on-cash return for rental property and a high P/E ratio for stock. Therefore, there aren’t a lot of good options to put the refinance cash into. And if you read my other article about Stock vs. Real Estate, you will understand my rationale for just staying in real estate.

So, strategy-wise, as dramatic as it might seem, we should stick to our long-term strategy. At least for me, I’ll keep on acquiring four-unit rental properties this year despite the escalated price caused by the low-interest-rate environment.

Accept with Online Payment

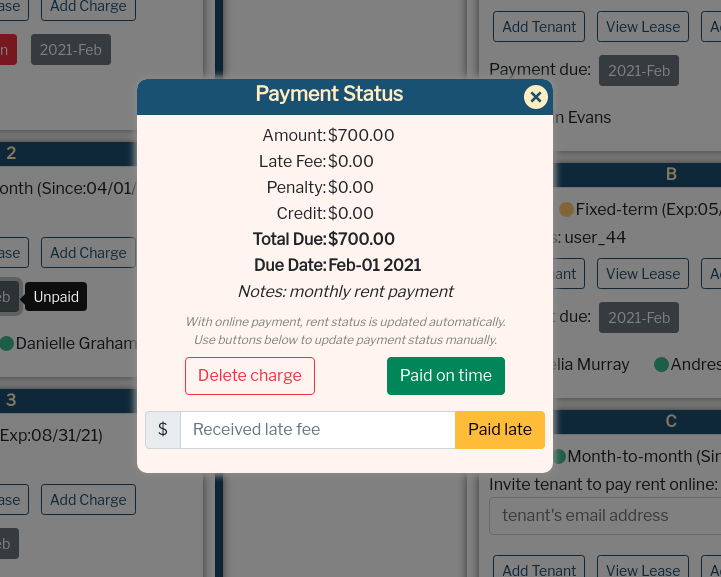

To put things in priority, I believe everyone would agree that your health is more important than your portfolio of properties. In a world where the pandemic is coming back again and again with different variances, independent landlords are particularly vulnerable, especially those who often interact with tenants. Statistically speaking, many tenants working in the retail, restaurant, and hospitality industry, and have a higher likelihood of contracting the illness through work. Since each landlord might interact with many tenants, the risk of contracting the illness shouldn’t be underestimated. Many independent landlords still rely on paper-check or, even, cash for the rent payment. In the post-pandemic world, for the sake of health and safety, it’s not just out of convenience, but a necessity to have an online payment option provided. Depending on the portfolio size, the small landlord may use Zelle or Venmo to collect rent. I personally use PortfolioBay, a free property management toolbox.

In PortfolioBay, the rent charge is posted with automatic late fees, and the receipt of rent payment is integrated with the accounting feature. Even when you are using tools like Zelle or Venmo to collect rent, PortfolioBay helps to track the payment status from all your tenants and it takes seconds to update the payment status and create an income entry in the accounting book.

Make showings more effective

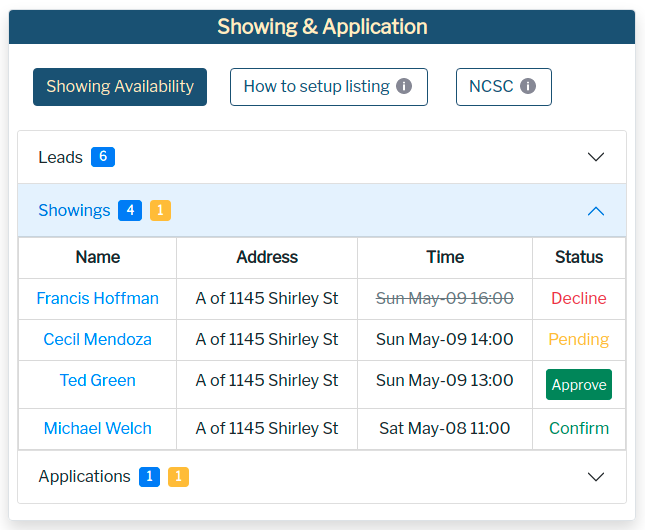

Another major in-person interactive activity for an independent landlord is the property showing during a unit turnover. To rent out a unit, an less experienced landlord can spend hours texting/messaging back and forth with prospective tenants, schedule for showings, and attending showings. In a post-pandemic world, we have to think about how to make the showings more effective and fill a vacancy quickly with a minimum number of shows.

Do we want to show the unit to someone who’s obviously going to be rejected in the application? do we want to show the unit to someone who is planning to move in two months later? Do we want to show the unit to someone who just expressed mild interest in Zillow? If we can have a process that filters out those disqualified, unsuitable, and low-interest inquiries, we can save a lot of time.

The property management toolbox I mentioned earlier is just designed with this in mind. The turnover feature can be integrated with Zillow, Trulia, Hotpad, and Apartments.com. Any inquirer will, first, receive a short form in order to schedule a showing. The form includes information like name, date of birth, move-in date, and reason for moving. Using that information, landlords can conduct searches against many public records, like state circuit court records, to determine suitability. If it was determined that the prospective tenant has a recent violent criminal history, eviction record, or move-in date too far into the future, the landlord can spell out the reason and reject the showing straight away, saving time for both parties.

Be cooperative and flexible

The pandemic has really hit people’s life hard. For those who could not work months at a time, it’s only rational to, first, put food on the table and then pay the rent. In those difficult times, the last thing a landlord should do is to “follow the protocol”. Even with the eviction moratorium, landlords can still rid tenants for reasons other than nonpayment. But is it the right thing to do? or a sensible thing to do?

We have to understand the point of such a protocol first. The protocol or process is designed to simplify decision-making under certain conditions. So, the implicit assumption of those protocols is that those conditions are still true. So, if we blindly follow the protocols without having a second thought about the underlying assumption, we could be making mistakes. For nonpayment and eviction proceedings, the usual protocol is designed to weed out bad tenants under normal circumstances. But a global pandemic isn’t a normal time, and many otherwise good tenants are affected as well. So, as an independent landlord, it’s especially important to be able to relate to the situation and come up with some cooperative and creative solutions to the challenges. For example, you can offer rent reductions for certain maintenance work to tenants or find rent assistance. You can find more details in my other articles on 3 things to Do Before Filing for Eviction.

Bottom line

To survive in the post-pandemic world as an independent landlord, we really have to stay focused on our long-term strategy, adopt a more modern approach process to make daily operations more frictionless, and be cooperative and flexible when it comes to facing challenging situations with tenants. In the end, being a good landlord is not just about “maintaining good cash flow”, but also about having happy “customers” (tenants) for your business.